Turn Every Dream Into a Reality with SIP – Systematic Investment Plan

Presented by Srinidhi Finserv

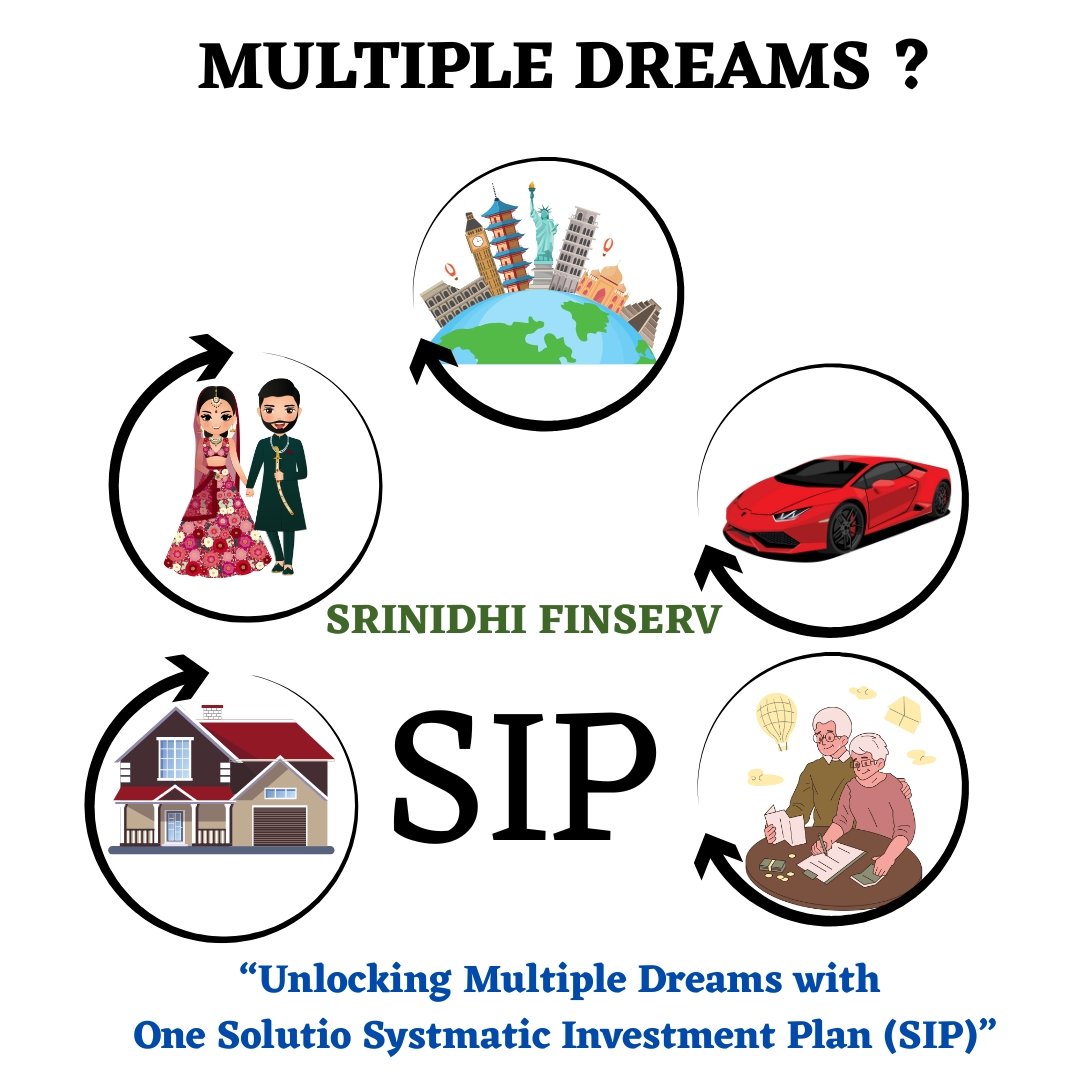

In today’s fast-paced world, we all have multiple dreams —

A beautiful home to call your own

A grand wedding for your children

A luxury car you’ve always wanted

That dream vacation across the world

A peaceful and financially secure retirement

But how do we turn these dreams into reality, without stress or heavy loans?

The Answer is Simple — SIP!

The Answer is Simple — SIP!

A Systematic Investment Plan (SIP) helps you invest small amounts every month into carefully chosen mutual fund schemes. Over time, your money grows with the power of compounding, turning small contributions into big achievements.

At Srinidhi Finserv, we guide you through this powerful journey by:

Understanding your financial goals

Selecting the right SIP plans based on risk & return

Tracking your investment performance regularly

Ensuring safety, transparency, and long-term wealth creation

Comprehensive Insurance Solutions – Your Shield Against Uncertainty

At Srinidhi Finserv, we believe true financial security comes from a holistic approach that protects your family, your health, and your dreams—today and tomorrow. That’s why we offer an end-to-end suite of insurance solutions, each meticulously designed to safeguard every facet of your life. Imagine the peace of mind that comes from knowing your loved ones are fully covered with a robust life insurance policy, your medical bills are taken care of by a comprehensive health plan, and any accidental mishap is met with prompt financial support through our accident insurance. Envision your home and vehicles shielded against fire, theft, and natural calamities, and your travels—whether for work or leisure—backed by travel insurance that covers unforeseen cancellations, lost baggage, and medical emergencies abroad. We also provide specialized education plans that ensure your child’s academic journey never stalls, business insurance solutions that protect your enterprise from liability and operational risks, and bespoke finance-protection policies that cover loan EMIs in case of critical illness or job loss. No matter what you value—your family, your assets, your ambitions—Srinidhi Finserv crafts the right mix of covers, offers seamless claim assistance, and fosters a relationship built on trust and transparency. Let us help you turn uncertainty into confidence, so you can focus on living life to the fullest, knowing that whatever the future holds, you’re ready.

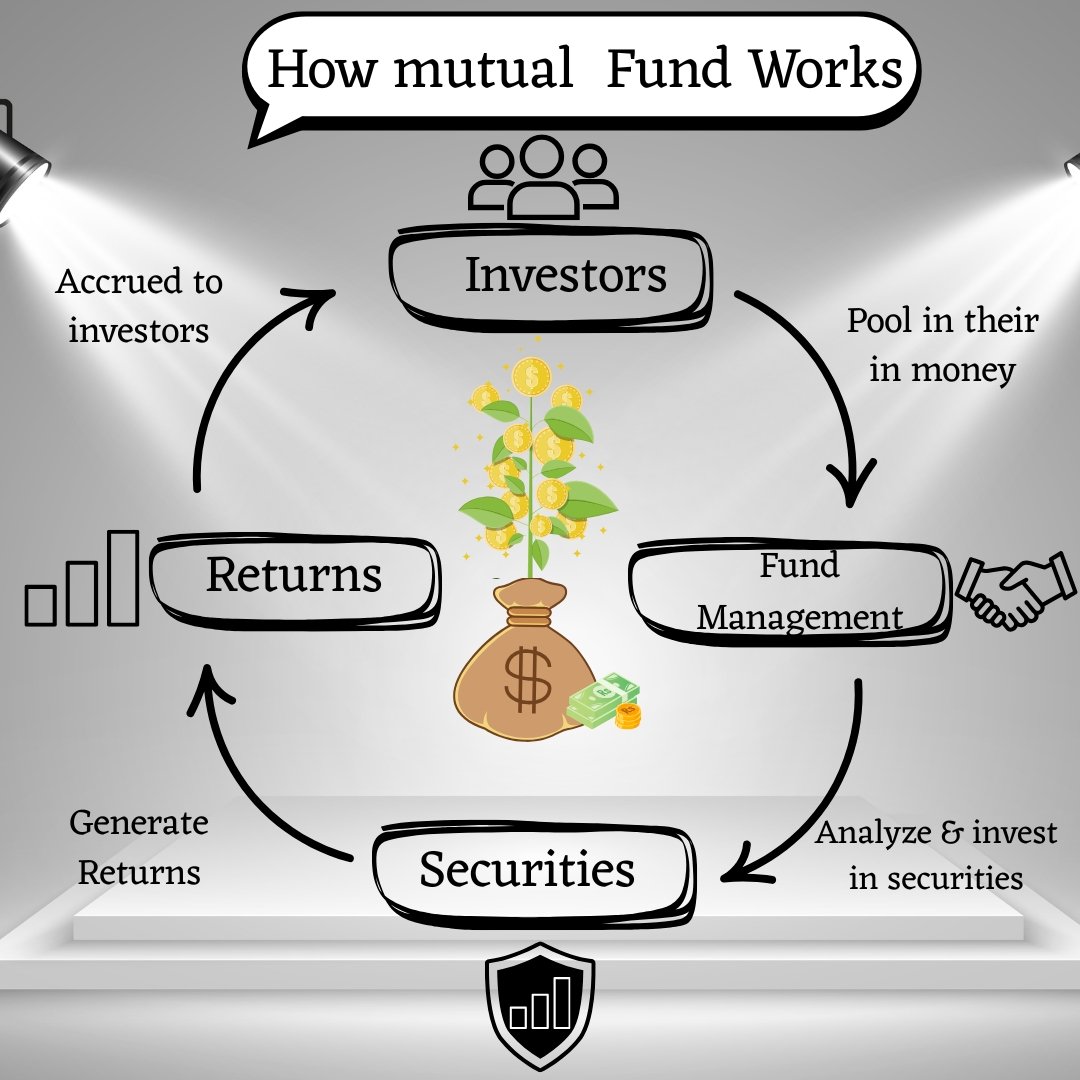

How Mutual Fund Works

At Srinidhi Finserv, we make wealth-building simple, smart, and systematic through Mutual Fund investments. A mutual fund works by pooling money from multiple investors who share a common financial goal. This collective fund is managed by professional fund managers who analyze the market and invest in a diversified basket of securities such as stocks, bonds, or other instruments. These investments are continuously monitored and adjusted to ensure optimum performance. As these securities generate profits over time, the returns are collected and distributed back to the investors based on their share in the fund. This process allows individual investors to benefit from expert management, risk diversification, and the power of compounding—even with small monthly investments. Whether your goal is long-term wealth creation, retirement planning, or achieving life milestones, mutual funds offer flexibility, transparency, and growth potential. At Srinidhi Finserv, we help you choose the right mutual fund plans based on your risk appetite, time horizon, and financial aspirations—ensuring your money works harder, smarter, and more efficiently.

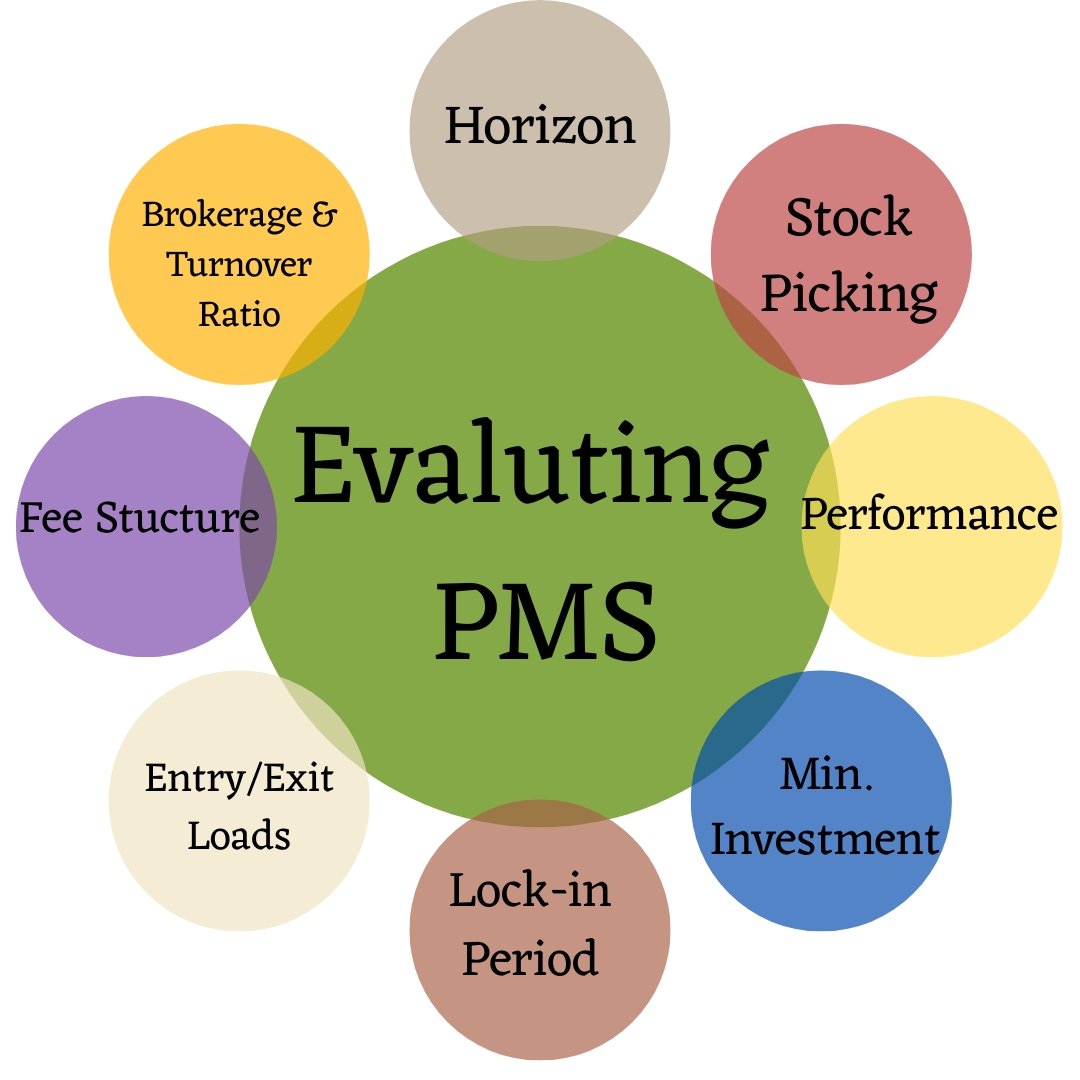

Evaluating PMS

At Srinidhi Finserv, we help high-net-worth individuals make informed decisions when it comes to Portfolio Management Services (PMS) by guiding them through a comprehensive evaluation process. Choosing the right PMS provider requires careful consideration of multiple factors to ensure your wealth is managed with precision and transparency. Key elements include your investment horizon, as PMS is ideal for medium to long-term goals. The stock-picking strategy and past performance of the portfolio manager play a critical role in maximizing returns. We also help you assess the minimum investment requirement, typically starting at ₹50 lakhs, and clearly explain the fee structure, brokerage charges, and turnover ratio to give you full financial visibility. Our evaluation also includes the impact of entry and exit loads, the presence of any lock-in periods, and the flexibility of fund withdrawals. With Srinidhi Finserv, you receive unbiased advice, continuous monitoring, and a commitment to helping your portfolio grow with confidence. Our aim is to ensure that your PMS investment is not only suitable but also aligned with your unique financial objectives and risk tolerance.